White Paper: Fintech Innovation Paving the Way to Financial Inclusion

FINCA Impact Finance is showing that fintech innovation and financial inclusion can overcome physical barriers in Democratic Republic of the Congo.

FINCA Impact Finance (FIF) is using fintech innovation to reach some of the world’s most isolated communities. Under FINCA 2.0, its network-wide digital transformation strategy, FIF is shifting to a “touch-tech” service delivery model that combines fintech innovation with a human-centered approach to delivering impactful financial services. This transformation cannot come soon enough for people in the Democratic Republic of the Congo (DRC). With less than 35 km of paved road for every one million inhabitants, the lack of physical infrastructure is a barrier to financial inclusion as well as to economic productivity and physical safety.

Traditional branch-based banking is not feasible for most of the DRC’s 81 million residents, and other channels are extremely scarce. However, basic financial services are needed. Even a small savings account can help a family cope with setbacks, which are all too common. Without that safety net, life can devolve into a daily financial scramble. Through fintech innovations, FIF is bringing banking closer to where people live and work, and offering them more customized options.

Download this White Paper in PDF format:

Fintech Innovation and Financial Inclusion Go Hand-in-Hand

With the support of partners such as Elan, FPM, IFC, Mastercard Foundation and UNCDF, FINCA DRC (a FIF subsidiary), continues to be at the forefront of this effort. In implementing FINCA 2.0, the organization is creating new products and delivery channels that emphasize outreach and efficiency. While increasingly utilizing digital channels, FINCA DRC is building even closer relationships with clients.

In 2011 they launched FINCA eXpress, a network of agents that allows people to do their banking at neighborhood shops—putting savings and credit within easy reach. FINCA DRC now has roughly 1,400 agents located around the country, processing more than 85% of the bank’s total transactions. This is the largest agency network of any country in which FIF operates.

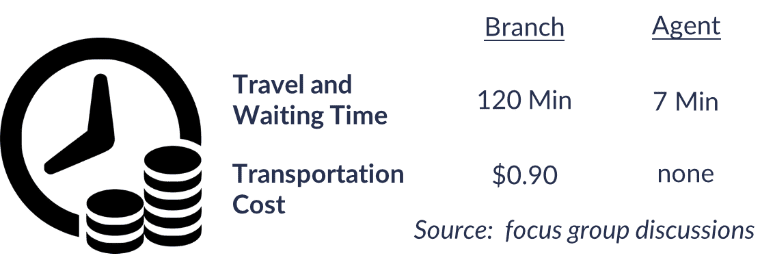

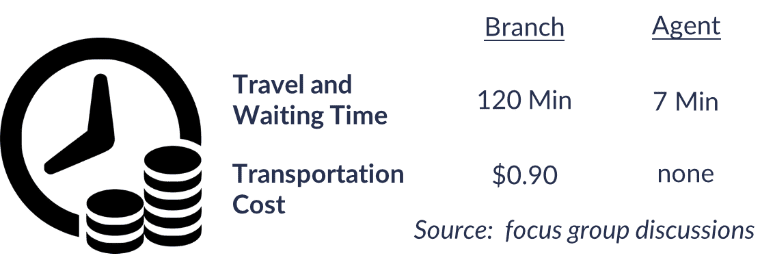

By reducing costs and travelling time for customers, banking agents are especially effective at reaching rural women, giving them the ability to pursue goals like growing a business or buying furniture. Research also shows that formal savings services can improve women’s control over the family budget.

In the DRC, the latest stage of FINCA 2.0 goes even further–literally putting financial services in the hands of customers through their mobile phones. This was not just a question of implementing a standard mobile banking platform, however–it required a ground-up rethinking of who the bank’s customers are, how they behave and how banking services can improve their everyday lives. The result is CLICK, a user-friendly, menu-driven mobile banking service that can be accessed with a common feature phone as well as with a smartphone. Users can open their own accounts, manage their balances, make transfers and receive payments from other users. The service operates without bells and whistles, using familiar text commands. This simplicity is part of what makes CLICK impactful, especially for people whose savings are measured in small daily increments. What’s more, many of the services offered through CLICK are free and users can even transfer money to non-CLICK users.

FINCA DRC designed CLICK for customers like Luiza M.*, who runs a small sewing business from her home in N’Sanda, a rural community several hours’ drive from Kinshasa. Over the past several months she has been stashing spare bills and coins in a jar that she specially chose because it has a narrow opening that reduces the temptation to raid its contents. As recent as a few days ago, the jar held just enough savings to cover her children’s upcoming school fees.

Today the jar is empty. Luiza’s husband has taken the money to repair his motorcycle, which he uses to transport people to the nearby bus station at Matadi. She can hardly argue with her husband’s priorities, especially since he is the family’s main breadwinner. But now weeks of careful, disciplined saving have gone to waste. Financial exclusion stands at the heart of her problem. If Luiza had a more formal, secure way to set aside spare cash, she wouldn’t be in a sudden scramble to find tuition—or else be forced to watch her children miss several weeks of school.

Now FINCA DRC offers her a solution. By activating a CLICK account during a visit to her local FINCA eXpress agent, Luiza can gain access to a digital wallet and accumulate savings on a regular basis, no matter how small the increments. Opening an account is paperless and fast. She can deposit a small number of Congolese francs each time she visits her local agent. A few simple keystrokes will allow her to check her balance and stay on target for meeting her goals. With a greatly reduced overhead, FINCA DRC can afford to accept the large number of small deposits Luiza will make as she regularly passes by the agent, without charging fees that would eat into her savings.

When she needs it, cash is just as easy to withdraw by visiting one of FINCA DRC’s full-service agents located in N’Sanda and throughout the country. Moreover, the bank is rapidly signing up schools to the platform so that customers can even pay tuition fees directly from their phone.

Savings are Only the Beginning

Getting savings out of a glass jar and into a mobile banking account may seem like a humble start, but it might be the most difficult–and important–step toward financial inclusion, for both FINCA DRC and its clients. Seven out of every ten digital banks in Africa have closed in the last year due to poor performance. But if savings form the foundation of a prosperous household, they are also the foundation of a commercially-viable bank and a healthy banking system. As Luiza gradually builds a savings history through CLICK, FINCA DRC can eventually extend a small line of credit, maybe even to pay for her husband’s next motorcycle repairs. FINCA 2.0 paves the way to this future. The sustained drive to better understand and serve our customers along the way is what will move us forward along that road.

*Luiza M. is a persona developed by aggregating several FINCA DRC clients.

This white paper was written for FINCA Impact Finance by Scott Graham, director of customer research and field data services for FINCA International, a US-based not-for-profit corporation. FINCA International is the founder and majority shareholder of FINCA Impact Finance.

Download this White Paper in PDF format: