Our History

FINCA Impact Finance (“FIF”) is a pioneer in financial inclusion. For nearly 40 years, we’ve developed market-based solutions to build sustainable communities and enable our clients to fully participate in the economy.

How we Started

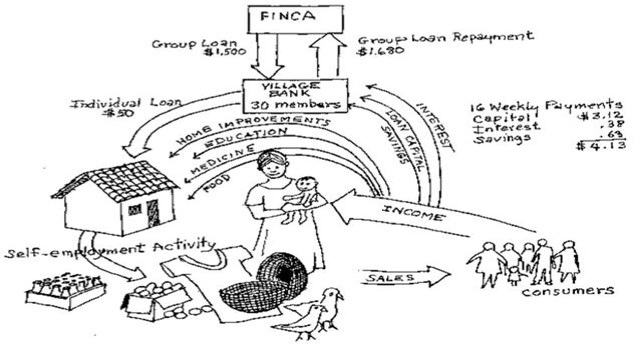

In 1984, founder John Hatch saw that lack of capital was keeping poor Bolivian farmers poor. Traditional loans were too large and too expensive, and without collateral, the farmers couldn’t borrow.

So he came up with an idea; if the farmers formed groups to share a loan and guarantee repayment, they could access the funds they needed to invest in their farming operations. It was the dawn of what we know today as microfinance.

The idea proved versatile and revolutionary.

In urban and rural areas, and in economies as diverse as Guatemala and Uganda, Village Banks (™) allowed those with scarce resources to borrow, invest and grow their businesses. They also allowed women—who were routinely denied credit—to build enterprises that kept food on their tables and their children in school.

Remaining true to its original idea, FINCA Impact Finance has become a global network of secure, sustainable microfinance institutions and banks that help low-income families create jobs, build assets, and improve their standard of living.

The Network

With more than 30 years of experience, FINCA Impact Finance delivers a double bottom line of social impact and financial sustainability. FINCA Impact Finance’s thousands of staff–mostly local–work across 15 financial services subsidiaries, four shared service centers, and the global headquarters in Washington, DC. We operate in some of the most challenging markets in the world with a geographic reach among the widest and most diverse of the leading responsible finance networks. Each of our subsidiaries is governed by its local board of directors. The local management teams are experienced professionals with sound understanding of their local banking sector, markets, and communities.

The majority owner of the FINCA Impact Finance network is FINCA International, a not-for-profit organization. FINCA International is joined by socially minded minority shareholders, including: the International Finance Corporation (IFC), KfW, Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO), Triple Jump and Triodos.