EFL and FINCA Partner to Provide Innovative Credit Scoring in Latin America

September 8, 2016, Washington, DC —In August 2016, FINCA, a leading global microfinance and social enterprise network, and Entrepreneurial Finance Lab (EFL), an alternative credit scoring company, partnered to improve individual lending and expand access to financial services in Latin America, starting in Guatemala. FINCA and EFL will work together to grow the individual lending portfolio, to improve loan officer productivity and most importantly, to save costs and time for FINCA’s clients. This partnership is starting in Guatemala and has the potential to expand to other markets.

September 8, 2016, Washington, DC —In August 2016, FINCA, a leading global microfinance and social enterprise network, and Entrepreneurial Finance Lab (EFL), an alternative credit scoring company, partnered to improve individual lending and expand access to financial services in Latin America, starting in Guatemala. FINCA and EFL will work together to grow the individual lending portfolio, to improve loan officer productivity and most importantly, to save costs and time for FINCA’s clients. This partnership is starting in Guatemala and has the potential to expand to other markets.

As one of the first microfinance institutions to do business in Latin America, FINCA started operations in Guatemala in 1997, introducing village banking as a tool to alleviate poverty. Today, throughout its 30-branch national footprint, FINCA Guatemala is leveraging new technologies to improve its services and make an even greater impact on Guatemalans.

For most Guatemalans, a lack of credit scores and formal borrowing history hinders the ability to access sorely needed capital to grow businesses. In this information-scarce microfinance market, less than 9% of adults are covered by credit bureaus and only 12% of the population borrows from formal financial institutions, creating an enormous gap in financial inclusion. Microfinance institutions have only partially filled this gap and the EFL partnership will allow FINCA to take this a step further.

“EFL’s innovative platform is a key next step in our mission to achieve financial inclusion in Latin America,” said Andrée Simon, co-CEO of FINCA Microfinance Holding Company. “By lowering FINCA’s costs, increasing the speed of our loan decisions, and providing more objectivity in our client assessments, this partnership will ensure that our low-income clients will be able to access the credit they need – safely, securely, quickly and more efficiently.”

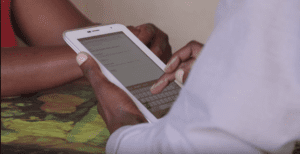

EFL uses alternative data such as psychometrics, digital footprints and cellphone usage information to assess the repayment risk profile associated with any individual. The potential borrower fills out the EFL application within 20-30 minutes and the data is analyzed to produce a credit score that assesses the applicant’s ability and willingness to repay a loan in real time. The EFL score provides FINCA with an efficient method of assessing the risk profiles of individuals that lack traditional credit information. The quick and objective tool will also help streamline operations by reducing time-intensive and sometimes subjective evaluations. Following the implementation of the EFL tool, the loan officer duties will be solely focused on affordability and business analyses for creditworthy clients who have been approved after scoring above an EFL cutoff score.

About FINCA

The FINCA microfinance network serves 1.8 million people in 23 countries with responsible and affordable financial services, including micro and small business loans, credit lines, savings, insurance, transactional services, and more. The majority shareholder is FINCA International, a Washington D.C. based not-for-profit organization with a mission to alleviate poverty through lasting solutions that help people build assets, create jobs and raise their standard of living. For more information, visit FMH.FINCA.org or follow us on Twitter @FINCA.

About EFL

The Entrepreneurial Finance Lab (EFL) is a pioneering financial technology firm that creates and analyzes non-traditional data to understand individual credit risk and enable access to finance for entrepreneurs and consumers globally. EFL helps leading financial institutions across 4 continents to better understand risk, increase efficiency and achieve strategic growth. EFL has been recognized and endorsed by leading development organizations such as the IFC, the Inter-American Development Bank, and the G-20. For more information, visit www.eflglobal.com.