Fintech innovation comes to rural Armenia

FINCA Impact Finance (FIF) is helping to transform the financial services industry by leveraging fintech innovations to deliver products that enhance customer service.

FINCA Impact Finance (FIF) is helping to transform the financial services industry by leveraging fintech innovations to deliver products that enhance customer service.

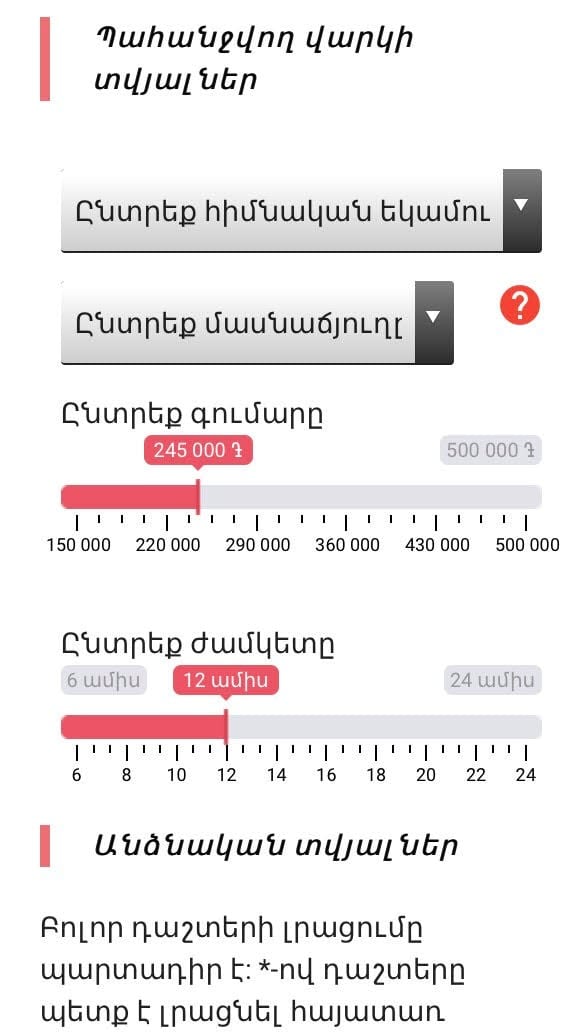

In May, FINCA Armenia updated its popular Online (OLA) platform, making it even easier for clients to apply for loans. OLA 2.0 features a streamlined interface, faster processing times, A.I. photo recognition technology and an automatic credit history generator. The new features not only make it more convenient to apply for loans but make loan processing times more efficient.

21% of all 2019 AMD loan applications through August were submitted online.

“With OLA 2.0, the goal was to make it as simple as possible for the customer. We wanted to improve the platform’s functionality, while enhancing the customer experience,” says Varduhi Sargsyan, Head of Marketing at FINCA Armenia, which is part of the FINCA Impact Finance Network, a group of 20 micro-finance institutions and banks that provide responsible financial services to low-income clients.

The original OLA platform was rolled out in March of 2018, and enabled customers the convenience of applying for loans remotely using a laptop or mobile device.

“Prior to OLA, the only way for our clients to apply for a loan was to physically enter one of our 38 branches. They would then have to wait for an answer and come back again to receive the loan once it was approved. The OLA platform changed all of this,” Sargsyan explains.

In addition to reducing the number of branch visits, OLA 2.0 provides loan applicants a fast response to loan inquiries. This is done by linking client data to the national credit bureau and state databases. Once they complete the simple application process, those who are approved will be contacted by a FINCA representative within 24 hours.

With banking products like OLA 2.0, the FIF network demonstrates that it is unafraid to harness the latest Fintech innovations to better serve its customers.